Are you a taxpayer and looking for a secure way to file your taxes? Get yourself registered on TRACES and streamline your tax payments. TRACES is a web-based application, primarily used to provide an interface to all stakeholders associated with the TDS.

This portal allows you to check challan status, Justification Report, Annual Credit Statement, Form 16/16A, and Conso File right from the comfort of your space. TRACES is launched with the intent to facilitate the taxpayers; hence, developers keep the website easy to use and beginner-friendly. You don’t have to be tech-savvy to make the best out of this portal.

Are you excited to uncover more details about TRACES? Keep scrolling the page and find everything you are looking for. This guide highlights every minor detail, including its login process to ease the readers. So, without any further delay, let’s get into it.

What is TRACES?

The portal, TRACES, mainly stands for TDS Reconciliation Analysis and Enabling Systems. It is created by Income Tax Department to ease the taxpayers out there. It is a technology-driven initiative taken by the tax department so that users can ease the process of tax filing and get everything done with a swipe of their fingertips.

Here’re listed the services available on this portal.

- View tax credit statement

- Registration for tax deductors and taxpayers

- Electronic filing of TDS statements

- View statement processing status and TDS defaults

- Digital TDS certificates

- Justification Report for details of TDS defaults

- Consolidated file for making corrections to the existing TDS statement

- TDS refunds

- Secure Integration

How to complete the Taxpayer Registration on TRACES Portal?

To make the best out of the portal, taxpayers first have to make registrations with the same. We have mentioned the complete step-by-step procedure so you can easily register yourself with ease.

TRACES Registration Portal

Open the web browser and navigate to the official link of TRACES.

- There, move your cursor to the left pane and locate the option saying “Registration as New User”. Click on it and move further.

- A new window will appear on the screen where you have to enter the required information, such as PAN, DOB, Surname, and others. Make sure to fill in the correct information and complete all fields marked with a red asterisk as they are mandatory.

- Once you are done with adding the details, it’s time to choose out of the three options, namely Details of TDS Collection/ Deducted, Challan Details of the Tax, and information of 26QB Statement filled by a buyer before making corrections. Choose the option wisely and add the appropriate information.

- Now, you will have to enter the address or contact information, such as email id, PIN code, mobile number, town/ city, state, etc.

- Check the added information thoroughly and click on the Next button to move to the next step.

- You will then be redirected to another page where you have to secure your account. Enter the password and security question to retrieve credentials in case you forget them.

- Tap on the “Create Account” button to view the confirmation screen.

- If all the details appearing on the screen are correct, then click on the Confirm button to set up your account with TRACES.

- Along with the confirmation, an activation link will be sent to your registered mobile number and email id. Keep it safe as it is the only way to access your TRACES account.

A complete guide to Activating and logging into your TRACES account

Login or activating your TRACES account is no hassle and users can easily do the same without putting in much effort. Follow the steps mentioned below and get it done with ease.

Account Activation

TRACES Active

Launch the official URL of the TRACES portal and go to the Login window on the homepage. Click on it and move next.

- Users will be redirected to another page where they have to add the User ID, Activation Code sent through emails, and code sent through SMS.

- Click on the Submit button and your account is now activated.

Account Login

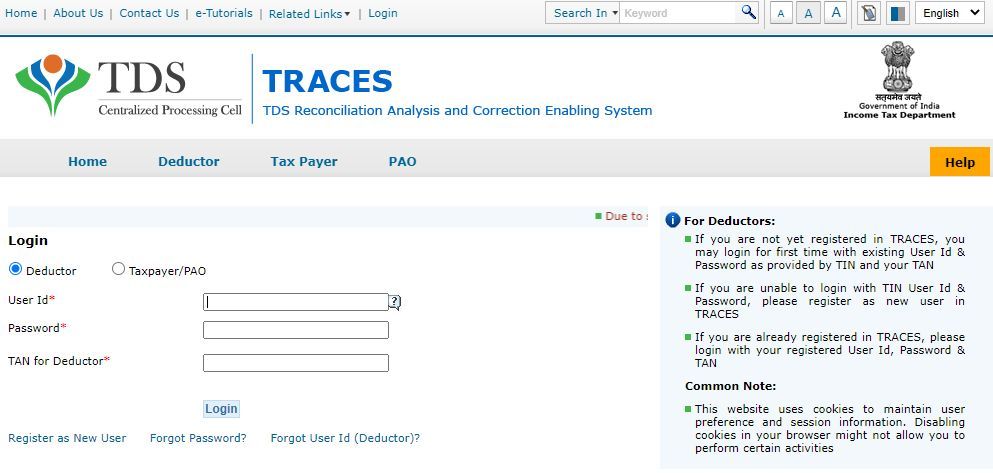

TRACES Login

To log into the account, go to the official portal and click on the Login option.

- Choose between Deductor and Tax Payer and then enter the username and password (that you have created at the time of registration).

- Along with this, enter TAN for Deductor or PAN for the taxpayer.

- Tap “Login” and you are now good to go.

Conclusion

That concludes with the step-by-step guide to activating and logging into the TRACES account. We hope our in-depth research will help you access the account and use the services with much ease and comfort.

Don’t panic if you face any trouble logging into the account as we are here to assist. Feel free to share your query with us and our experts will be readily available in the hour of your need. Stay tuned with us for more guides.